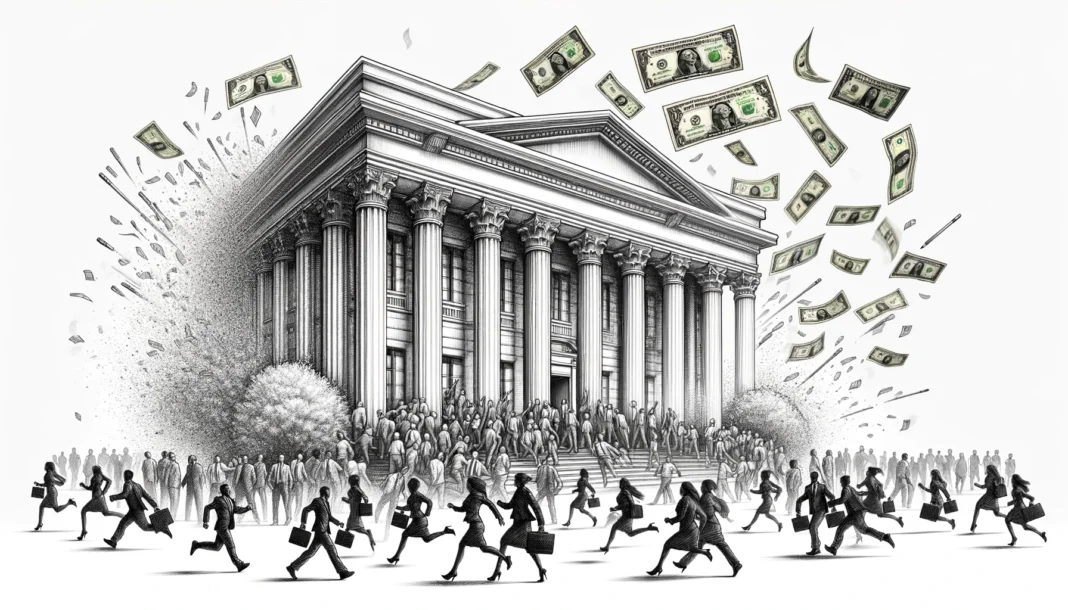

In a startling revelation, the Central Bank of Russia has reported an astonishing volume of cryptocurrency exchange transactions worth nearly $52 billion for the year 2023. This news, as reported by Cryptonews, has sent shockwaves through the global cryptocurrency community and raised questions about the factors driving such significant activity in the Russian crypto market.

Russia’s emergence as a major player in the global cryptocurrency market comes as no surprise to industry observers. Over the past few years, the country has witnessed a steady increase in crypto adoption, fueled by factors such as regulatory clarity, technological innovation, and changing consumer preferences. With a population of over 145 million people and a vibrant tech-savvy community, Russia represents a fertile ground for cryptocurrency usage and investment.

The reported volume of cryptocurrency exchange transactions reflects a growing appetite among Russian investors and traders for digital assets, as well as the increasing integration of cryptocurrencies into mainstream financial systems.

Several key factors may help explain the surge in cryptocurrency exchange transactions in Russia:

In recent years, Russia has made significant strides in providing regulatory clarity for the cryptocurrency industry. The adoption of the Digital Financial Assets (DFA) law in 2020 laid the groundwork for the legal recognition of cryptocurrencies and blockchain technology in Russia, providing greater certainty and confidence for market participants.

Russia’s geopolitical landscape has also played a role in driving cryptocurrency adoption. Economic sanctions imposed by Western countries have led some Russian businesses and individuals to explore alternative financial instruments, including cryptocurrencies, as a means of circumventing traditional banking restrictions and accessing global markets.

Technological advancements in the crypto space have made it easier than ever for Russians to buy, sell, and trade digital assets. The proliferation of user-friendly cryptocurrency exchanges, mobile wallets, and decentralized finance (DeFi) platforms has democratized access to crypto markets, allowing individuals from all walks of life to participate in the digital economy.

Like many countries, Russia has grappled with inflationary pressures in recent years, driven in part by economic uncertainty and geopolitical tensions, namely, the war that Russia started against its neighbor, Ukraine, by attacking the territory of another country. Cryptocurrencies, with their finite supply and decentralized nature, offer a hedge against inflation and currency depreciation, making them an attractive investment option for Russian investors seeking to preserve and grow their wealth.

The influx of institutional capital into the cryptocurrency market has further fueled the growth of crypto transactions in Russia. Institutional investors, including hedge funds, asset managers, and family offices, are increasingly allocating capital to digital assets as part of their investment portfolios, driving liquidity and market activity.

The surge in cryptocurrency exchange transactions reported by the Central Bank of Russia has significant implications for the broader crypto market:

Russia’s growing presence in the cryptocurrency market represents a significant expansion of the global crypto economy. As Russian investors and traders increasingly participate in crypto transactions, the overall liquidity and depth of the market are likely to increase, providing new opportunities for growth and innovation.

Regulatory developments in Russia will continue to shape the trajectory of the country’s cryptocurrency market. Clear and favorable regulatory frameworks can encourage further adoption and investment in digital assets, while uncertainty or restrictive regulations may hinder market growth and innovation.

Russia’s rising prominence in the cryptocurrency space could also have broader geopolitical implications. As one of the world’s largest economies and a major player in global politics, Russia’s involvement in the crypto market could influence international perceptions and policies regarding digital assets and blockchain technology.